Today we’re taking a little deep dive into a startup I’ve mentioned several times in the newsletter.

Stablegains - or - as I like to refer to it “Unstable Losses”

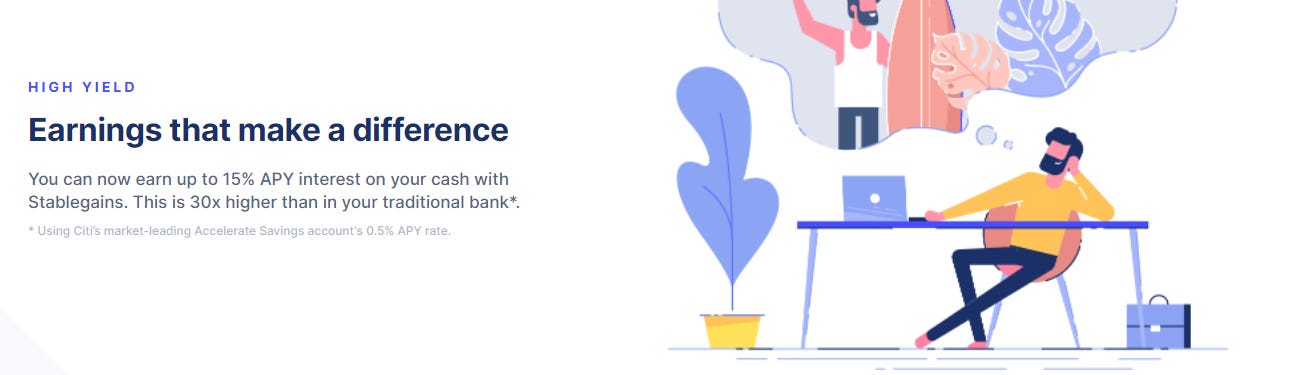

Several months ago - my wife saw an ad for a company called Stablegains that promised a 15% APY with “no surprises.”

I did some research and saw that they were Y Combinator backed, and their documentation seemed to be on point. Sounded cool! I was on board. :)

They even had completed several successful fundraising rounds - with 3 Million recently in April.

So - into the documentation, I went.

Articles like this that seemed quite positive.

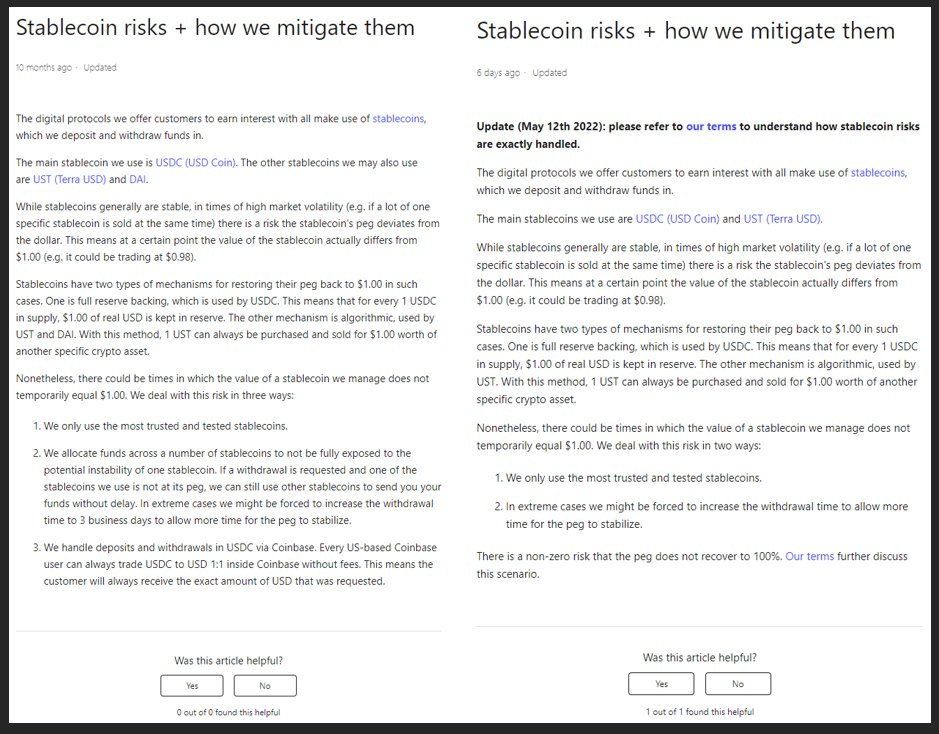

Below are the sentences that sold me. Unfortunately - I had to rely on screenshots because Stablegains has been actively changing content.

Not SUS at allllll

They won my heart like a NFT with a decent roadmap.

Just look at that second point there.

Sounds legit - right? Based on the way this copy is phrased - if UST dumps, thennn I can get a withdrawal via another stablecoin.

Would you be surprised to learn that they deleted this in the updated version? Here - check out the updated version on the right side.

The original makes it sound like they’re mitigating risk - saying that they’re not “completely exposed” to any one stablecoin. If one crashes - they can switch to the other.

Unfortunately - this copy was simply untrue. Stablegains had completely degenned into UST and the Anchor Protocol - without really making it clear and transparent to the user.

Here’s a tweet from their “defense thread” today.

The original copy made me think - “well if one stablecoin goes to hell, surely they have some kind of backup plan.”

You know like - “Ok UST is down to 90 cents - let’s switch to USDC or BUSD or USDT”

If I can degen buy $30 worth of some random coin I found, then swap out as soon I lost $10 (and lose $5 more bc I had to to 15% slippage) SURELY a startup can do the same thing - right?

SURELY a startup with millions in funding has some sort of emergency backup plan that at least saves some of its clients money?

After all - this is a company called “Stable Gains.” It has professional branding - and is directed at the average consumer. I don’t see a single “degen” or “Pepe meme” in sight.

That was my philosophy going in - and so we invested a bit of money. $2800 to be exact.

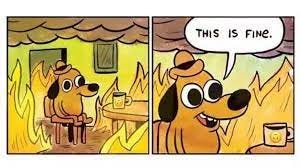

Honestly - I kinda had the same perspective as this person on Twitter. Based on Stablegains copy - it seemed that I didn’t have to worry about losing my funds.

For a while - things were good. Our money was earning about $30 for us a month. It was great!

Then UST depegged - and Stablegains started wringing their hands.

We got an email - and I thought to myself “well based on their website copy that indicated they were being smart with money, I should have only lost some $$ - which is fine. Crypto is risky lol. I’ve lost $ before - no big deal.”

NOOOOOOOOO

Rather than start swapping as soon as UST depegged - Stablegains chose a more “degen” approach.

DOWN ONLY DIAMOND HANDS ON UST. 💎💎💎💎

Then - they made a new stunning annnouncement.

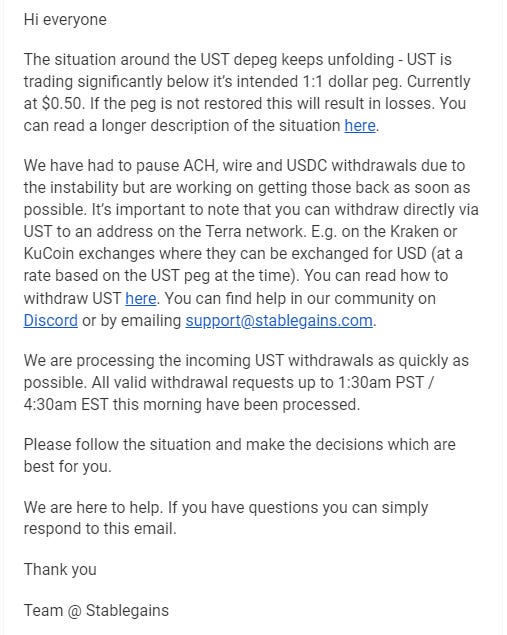

Withdraw your UST to an exchange - or keep holding in our platform.

UST? Seriously?

Stablegains was aimed at the average consumer. The average consumer probably doesn’t know how to send UST to Kucoin.

(Heck - I barely have a Kucoin account. I was an OG Binance user before they banned US users - and never really cared for Kucoin or some of the other exchanges. I really should have moved the UST to Kucoin - but was still really upset + hoping Stablegains would have some kind of solution).

Their Instagram account very clearly has posts that are more empathetic towards normal retail investors. Notice here the language of “savings.”

The Copy is a’ Changing

A quick glance at Stablegains since March demonstrates that they’re trying the old “Cover Your Ass” as fast as they can.

The “normal consumer” words of “savings,” and “withdraw anytime” gotta go. After all, with UST crashing - neither of those words apply anymore.

Let’s take a little look - shall we?

We’re gonna go back to a March Snapshot via Archive.org

THE NEW

Notice the subtle difference here? Gone are the word “savings” and “stable.” Semantically - both of those words communicate traditional safe finance language. Both of those words communicate to consumers that this is just as safe as a bank account - whether Stablegains intends this or not.

They keep doing this throughout the landing page.

THE NEW

Notice how Withdraw anytime has been removed? It’s been changed to “No long-term lockups.” Withdraw anytime didn’t end up being the most transparent honest copy did it?

THE NEW

Here - savings has been removed again - and the word is now “cash.” Stablegains doesn’t want to imply the safety of the word “savings” anymore.

15% is no longer concrete - but “up to.”

THE NEW

Bye Bye “Withdraw your funds anytime” ORRRRR “There are no lock-up periods.”

THE NEW

15% is gone - as it was dependent on the Anchor Protocol.

THE TESTIMONIALS HAVE BEEN REMOVED

Ok - Let’s check out the real fun stuff

THE NEW

Notice how the words “diversified selection of Defi lending markets” has been completely removed - AND - they’ve added the bit about Anchor Protocol.

The previous sentence very clearly communicated what was said originally in the original screenshot that Fatmanterra captured.

Y Combinator has been removed as well.

As can be plainly seen from all the previous screenshots - Stablegains is removing anything that would indicate “safety” “stability” or “savings.”

The Discord link was also removed from the bottom of the site - but I just hopped in and the server is still active.

Here - hop in and start reading. The mods are not modding in any way. It’s a complete wasteland of frustration.

I’m surprised Mods are still making announcements.

The Emails

Stablegains sent out some fun emails when UST depegged.

Let’s wade through them, shall we?

May 9: Stablegains still sounds hopeful - as if there’s still a chance UST will return to normal. They’re already trying to cover their tracks - as they emphasize how you knew allllll along about the Anchor Protocol and them completely degenning into Anchor.

May 10: Things start sounding a bit dire - but still hopeful. Maybe you should take your $ out?

May 11: Hope is now ded. Stablegains is now eager for you to withdraw your UST.

May 13: Damage Control + Fud activated - with a hint of sympathy/ “we’re in the boat with you.” We lost our money too - shouldn’t you be ok too?

May 14: Things get weird - Stablegains offers counsel - - but immediately removes the offer. I wonder if their lawyer straight up said “no fam. no”

Later that day

May 15: At this point the message seems to be “please withdraw” - especially if Terra’s network ceases to exist.

May 17: Now Stablegains is REALLY wanting you to withdraw

The Present

It looks as if a class action lawsuit has been brought against Stable Gains - and some users in the discord are opening disputes with their banks.

It also looks as if Stablegains isn’t going to figure out how to get in on the possible airdrop to UST holders from the new Luna Fork.

Users will be on their own to figure that out.

Conclusion

It’s really disappointing to see Stablegains taking this tack + defense. Rather than actually apologizing + listening to users - they’re rushing to defend themselves against critique.

All they needed to say was “We really screwed things up. We’re sorry. Maybe we can’t give you all your $ back - but we’re gonna figure out as best we can how to make this right.”

I think I’m most upset that they’re covering stuff up on the website.

Stablegains.

Be honest.

You didn’t explain things clearly.

You should have highlighted more risk.

You SHOULD NOT have ran ads or used social media posts

Stablegains - you are anything but.

If you enjoyed this special issue of “The Land of Random” please subscribe for more of my random content every week. I tend to cover tech, vaporwave, eco tech, and a bit of Web 3 - every Monday.

What’s the way forward now? I have no clue what a UST is let alone trade it. This is awful. I never invest in anything like this, I’m beyond devastated now. I’m in debt even.